The Ultimate Guide To Hard Money Atlanta

Wiki Article

Getting My Hard Money Atlanta To Work

Table of ContentsHard Money Atlanta for DummiesThe Best Guide To Hard Money Atlanta4 Simple Techniques For Hard Money AtlantaHard Money Atlanta - Questions

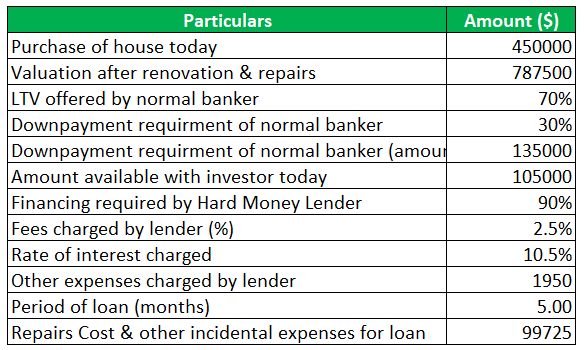

In most areas, rate of interest on tough cash car loans range from 10% to 15%. In enhancement, a consumer might require to pay 3 to 5 points, based on the total finance quantity, plus any type of suitable evaluation, assessment, as well as administrative fees. Numerous hard money lenders call for interest-only settlements throughout the brief duration of the funding.Difficult cash lending institutions make their cash from the rate of interest, points, and also charges charged to the borrower. These lending institutions seek to make a quick turn-around on their financial investment, thus the greater rates of interest and much shorter terms of hard cash fundings. A difficult cash financing is an excellent idea if a consumer requires money swiftly to purchase a home that can be rehabbed and flipped, or rehabbed, rented and also refinanced in a fairly brief amount of time.

They're additionally great for capitalists who do not have a great deal of security; the residential property itself becomes the security for the lending. Tough money financings, however, are not excellent for conventional home owners intending to finance a building long-term. They are a beneficial device in the investors toolbelt when it concerns leveraging cash to scale their organization.

For private financiers, the ideal component of getting a hard money financing is that it is simpler than getting a conventional home loan from a financial institution. The authorization procedure is generally much less intense. Banks can request a virtually endless series of files as well as take a number of weeks to months to obtain a lending approved.

About Hard Money Atlanta

The main purpose is to make sure the debtor has a leave method as well as isn't in monetary spoil. Numerous hard money lenders will work with people that do not have wonderful credit scores, as this isn't their largest worry - hard money atlanta. The most important thing tough money lending institutions will look at is the financial investment building itself.They will additionally examine the customer's extent of work and also budget to guarantee it's reasonable. Sometimes, they will certainly stop the process because they either believe the residential or commercial property is too much gone or the rehab spending plan is unrealistic. Lastly, they will certainly assess the BPO or assessment and the sales and/or rental compensations to guarantee they agree with the assessment.

There is one more benefit constructed into this process: You obtain a 2nd collection of eyes on your deal and also one that is materially invested in the task's outcome at that! If an offer misbehaves, you can be fairly positive that a tough money loan provider won't touch it. You should never use that as an excuse to abandon your own due diligence.

The most effective location to seek tough cash lenders is in the Larger, Pockets Tough Cash Lending Institution Directory Site or your neighborhood Property Investors Organization. Bear in mind, if they have actually done right by one more financier, they are most likely to do right by you.

Our Hard Money Atlanta Ideas

Continue reading as we review difficult money finances as well as why they are such an attractive alternative for fix-and-flip genuine estate financiers. One significant advantage of hard cash for a fix-and-flip financier is leveraging a trusted lending institution's trustworthy funding and also speed. Leveraging means making use of various other people's cash for investment. Although there is a risk to funding an acquisition, you can free up your very own money to acquire read what he said more residential properties.You can handle tasks incrementally with these tactical loans that enable you to rehab with simply 10 - 30% down (depending on the loan provider). Hard money finances are typically short-term finances made use of by investor to money solution and also flip homes or various other property investment deals. The property itself is used as collateral for the funding, and content also the top quality of the actual estate bargain is, consequently, more crucial than the consumer's credit reliability when getting the financing.

However, this also implies that the risk is higher on these fundings, so the rate of interest are normally higher too. Repair and turn capitalists select difficult money because the marketplace does not wait. When the chance occurs, and you prepare to obtain your job into the rehab stage, a tough money funding gets you the cash straightaway, pending a fair assessment of the business bargain.

How Hard Money Atlanta can Save You Time, Stress, and Money.

Intent as well as residential or commercial property paperwork includes your in-depth range of job (SOW) as well as insurance policy. To analyze the property, your lender will look at the value of comparable buildings in the location and also their estimates for development. Complying with a quote of the residential property's ARV, they will fund an agreed-upon percentage of that value.

Report this wiki page